This analysis highlights the strategic value of customer behavior research in shaping revenue growth, improving satisfaction, and refining market targeting. Even in the absence of product-level data, we uncovered patterns in spending, engagement, and loyalty that directly inform marketing, pricing, and retention strategies.

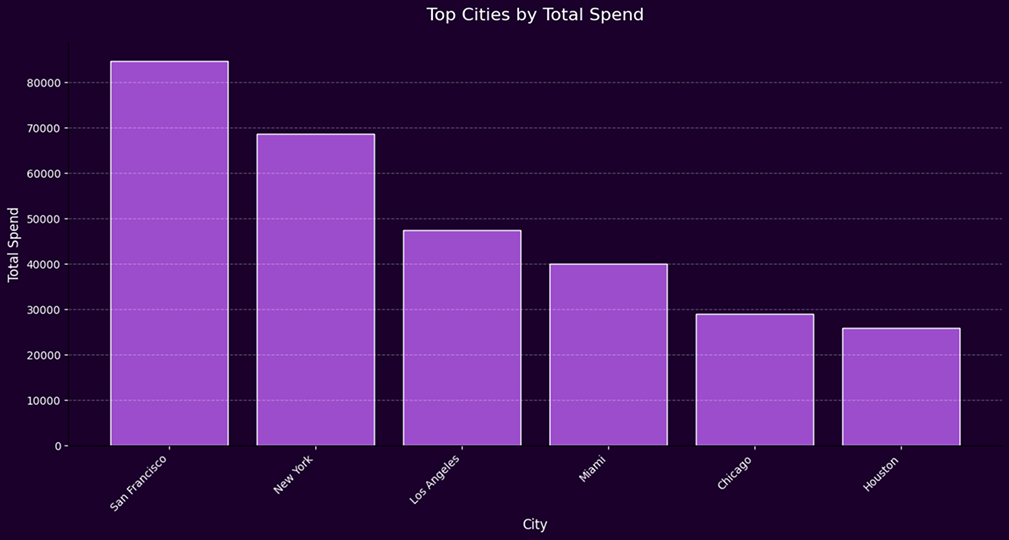

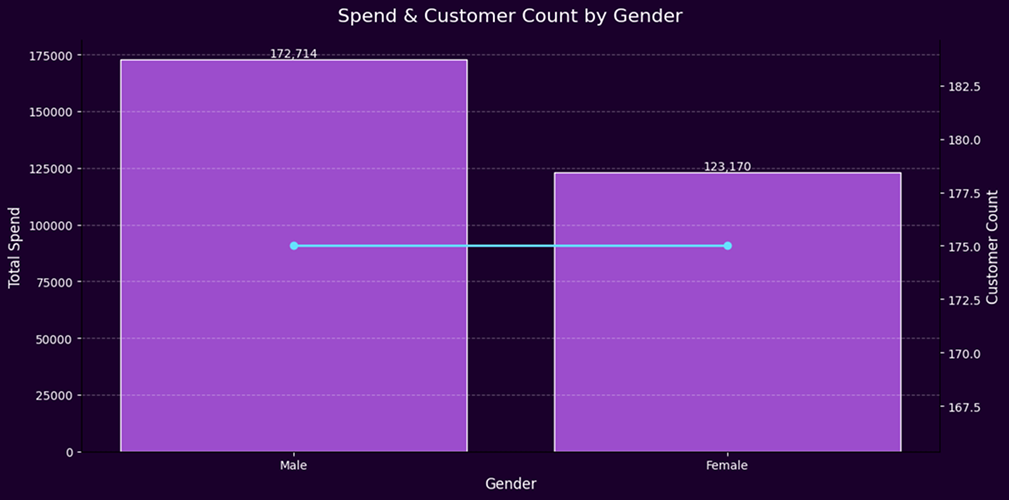

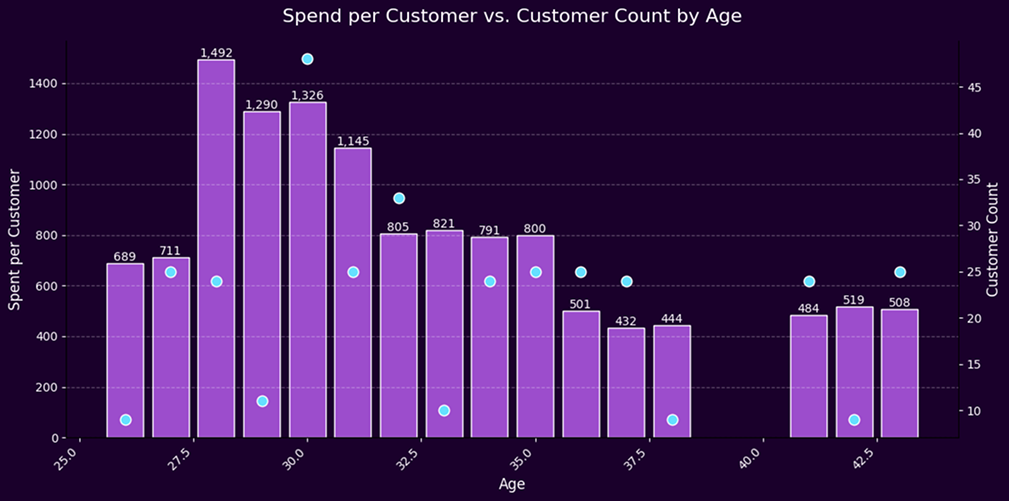

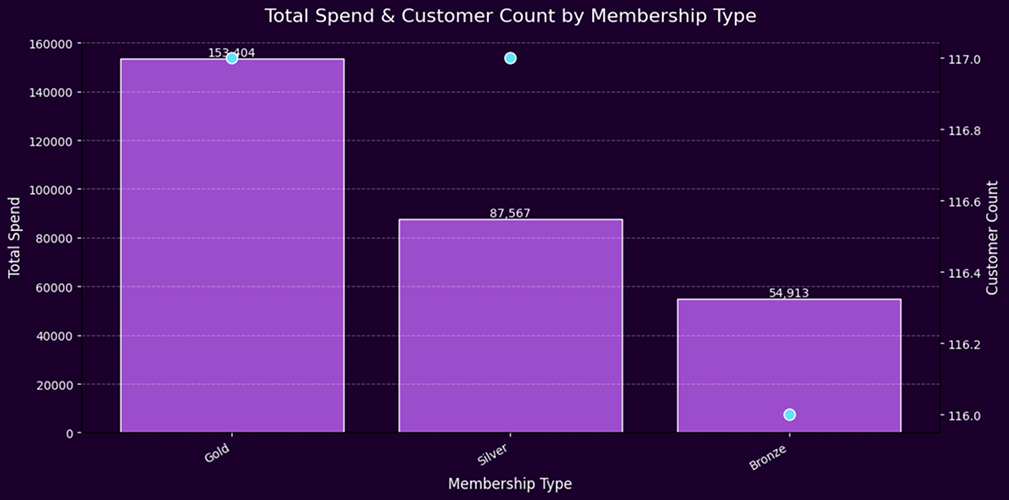

Our findings reveal that San Francisco generates higher total spend than New York despite having a slightly smaller customer base, showing that revenue potential is not solely tied to volume. Gender-based insights indicate that male customers spend significantly more, purchase more items, and express higher satisfaction, while female customers report a greater proportion of dissatisfaction. Addressing this gap presents a clear opportunity to enhance satisfaction and increase revenue from the female segment. Age analysis shows that while 30-year-olds are the most numerous, 24-year-olds lead in per-person spending and purchasing, suggesting that targeted engagement with high-value age cohorts could yield substantial returns. Membership analysis confirms that Gold-tier customers spend more, reinforcing the value of optimizing membership benefits to encourage upgrades.

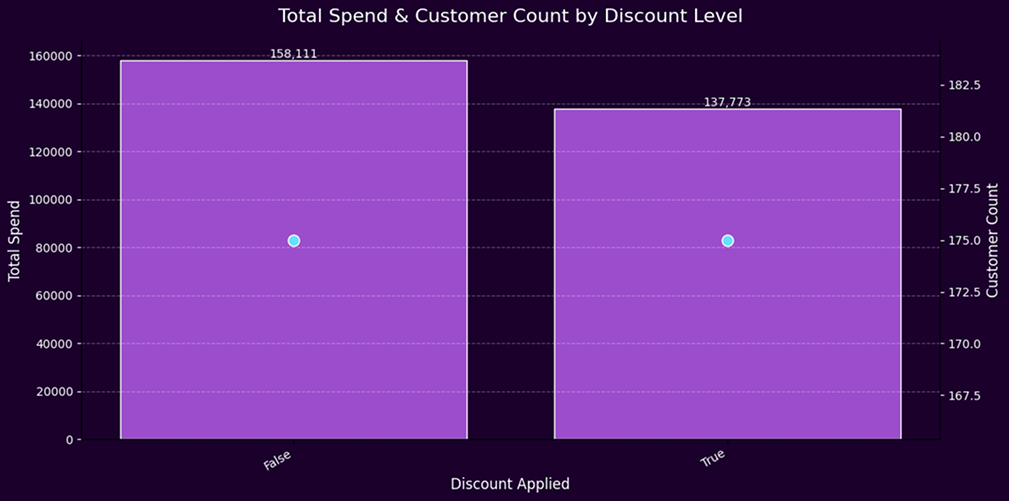

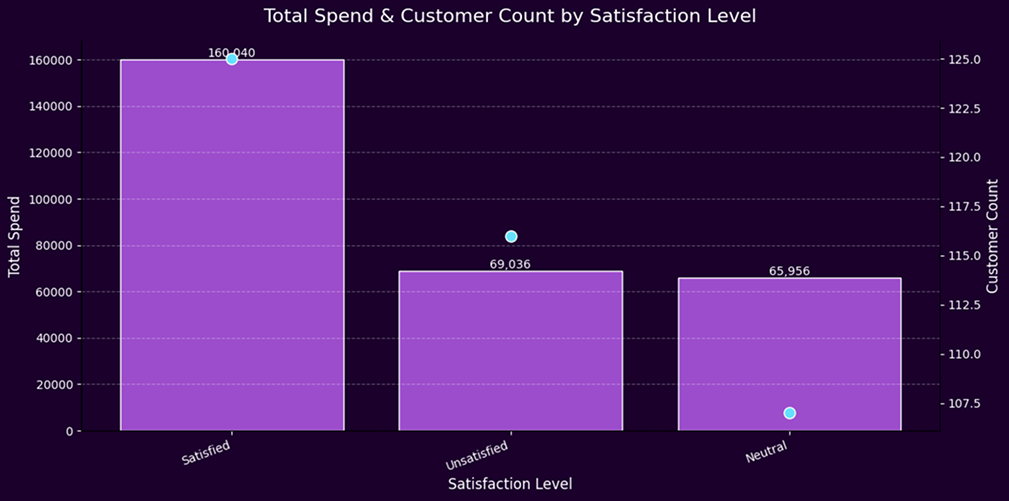

Interestingly, purchase patterns challenge conventional assumptions about discounting: customers who buy without discounts spend more and purchase more items than those who do, suggesting the need to reassess promotional strategies for profitability. Satisfaction levels further underline the importance of experience quality; satisfied customers spend the most, yet the presence of a large neutral and unsatisfied segment signals untapped potential for growth through service or product improvements.

Taken together, these findings demonstrate that customer behavior analysis is more than a descriptive exercise—it is a strategic tool for uncovering revenue levers, improving customer experiences, and guiding resource allocation. By translating insights into targeted actions, organizations can move from broad, undifferentiated strategies to focused, data-driven decision-making that maximizes both profitability and customer loyalty.

View the full code behind this analysis in our Google Colab notebook.